Economists have increasingly begun to study the impact of Gen Z, i.e., those born from the mid-1990s to the early 2010s, on the global economy. That generation is now entering the workforce, and its impact is considered to be revolutionary. Gen Z represents the fastest-growing accumulators of wealth ever recorded, and they are predicted to surpass millennials by the early 2030s.

Of course, when speaking of these global economic trends, it is important to point out that other factors should be taken into account. Circumstance matters. A 25-year-old born here in Monaco will have a different set of economic circumstances than a 17-year-old from Haiti or Eritrea. Yet that, too, is changing. Globally, 90% of Gen Z comes from economically developing regions, which will harness the digital age to oversee the biggest transfer of wealth in history.

Gen Z values wealth differently

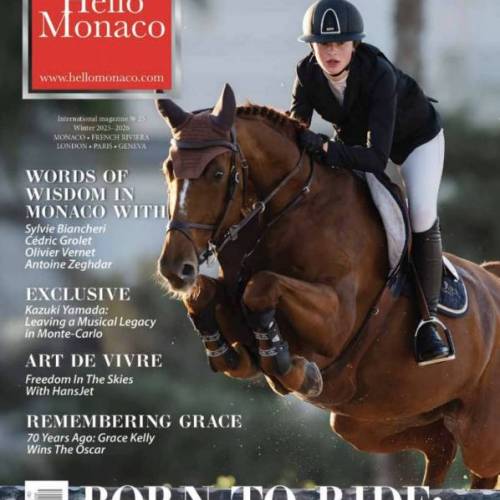

It’s interesting to see how Gen Z has a shifting attitude toward wealth. Generations past, particularly the dominant Baby Boomer generation, have a more rather rigid view of what symbolizes wealth. You might look at the yachts moored in the Port Hercule here in Monaco, the universal symbols of wealth like champagne bottles and private jets depicted in games like VIP Filthy Riches, and the clothes and watches that we wear. Gen Z sees that too. But they have a more multifaceted outlook.

Fortune Magazine recently released a report that looked at how Gen Z differed in how it viewed wealth. It was the first generation not to have the term “financially secure” as the top marker for wealth, placing it second behind “having a better quality of life”. There are similarities in the two ideas. In the simplest terms, previous generations saw wealth as having things – homes, cars, money – and Gen Z sees wealth as doing things, like having vacations, going to concerts, and so on.

Challenges in debt and home ownership

Again, when we talk of these huge global economic trends, it is important to state that there is nuance and disagreement. We started by saying that Gen Z was the fastest accumulator of wealth, but there have also been roadblocks – the global pandemic, interest rates, and the 2008 global recession, for example, were all barriers that impacted and continue to impact wealth accumulation. Owning a home is also more difficult, and there is a growing sense that traditional models will have to be disrupted.

Moreover, there are shifting attitudes from younger generations on the justice of the economic system. As Baby Boomers retire and pass on, the expectation is that the younger will inherit and become richer. This is true on the macro level. However, there is also some acrimony. Gen Z, while richer, is increasingly saddled with debt, particularly educational debt. This has allowed some to start questioning the worth of university education.

Interestingly, but anecdotally, there seems to be a growing sense that wealth is not acquired through circumstance but through individual factors. Worryingly, this has given rise to the idea on social media that everyone should be rich, and that there are no excuses for failure. Much of this can be linked to the cryptocurrency boom, which saw so many young people become rich, literally overnight. Darker forces are at play here, with social media influencers challenging the idea of self-worth of younger people.

In the end, there will be challenges for younger generations. People will live longer, and Gen Z is not saving for retirement with as much regularity as older generations. Here in Europe, they will have to deal with sluggish economic growth as wealth is transferred to developing nations. But Gen Z has challenged ideas of wealth more than any other. It thinks about it in a different way, and that may not change as they get older.