The interest in art and collectibles as part of a holistic wealth management strategy continues. Technology, changes in regulations, and social impact investing are key trends to shape the art and finance market in 2019 and moving forward.

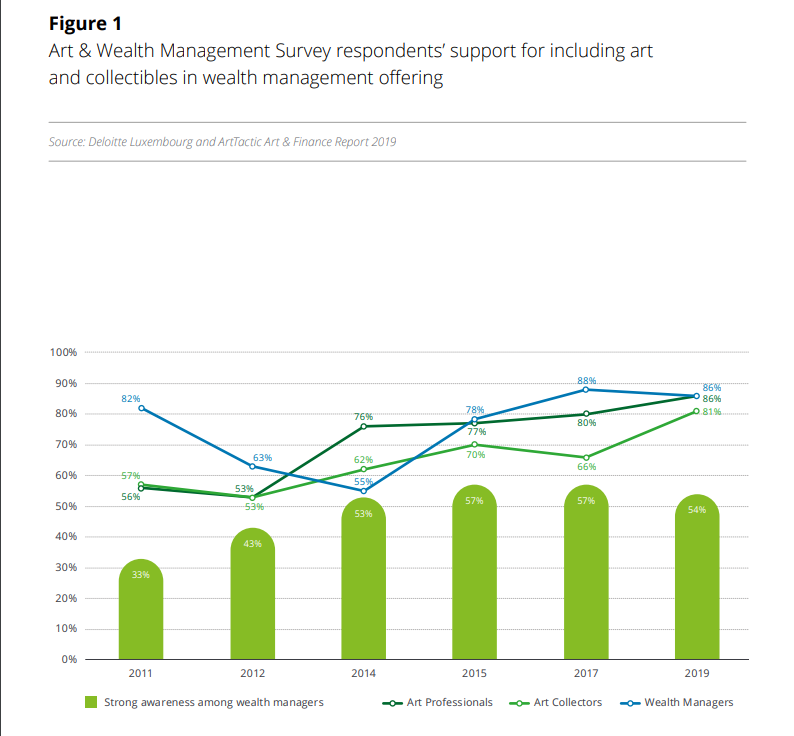

Luxembourg, 14 October 2019: The trend of including art and collectibles in wealth management portfolios and wealth reports is as strong as ever according to the sixth edition of the Deloitte and ArtTactic Art & Finance Report 2019. 81 percent of collectors are expecting such holistic service offering from their wealth managers, an increase from 66 percent as seen in 2017.

Ultra-High-Net-Worth Individuals’ wealth associated with art and collectibles was worth an estimated US$1.742 trillion in 2018 and is expected to grow further according to the Deloitte report. This year’s survey results show particularly high agreement among wealth managers, art professionals, and art collectors that art is an important component of a wealth management service offering (see Figure 1). This opinion marks the strongest consensus on this point since the launch of the survey in 2011.

However, despite the increase in the High-Net-Worth-population and a boosted interest in art as an asset, growth trends in the art market have been anaemic when compared to the growth in global wealth. “The findings reveal that lack of transparency is an ongoing concern for collectors, causing continued distrust in the market. In addition, a newer challenge derives from next-generation investors whose interests extend beyond financial returns to social impact,” states Adriano Picinati di Torcello, Director and Global Art & Finance Coordinator at Deloitte. “This year, we identified three trends that directly or indirectly look to address these concerns: technology, regulatory changes, and social impact investment models.”

Technology as an accelerator for art and finance services

One promising model to better combine tech investments with efficient long-term strategies is a development of an angel-investor network for ArtTech startups:

“This angel-investor network would rely on art professionals and collectors who know the market, its functioning and particularities. Such a network could be integral in directing money into those projects that address concrete issues within the art world, and align long-term expectations from investors, when providing better understanding of how the art market works,” explains Picinati di Torcello.

Regulations to instil trust

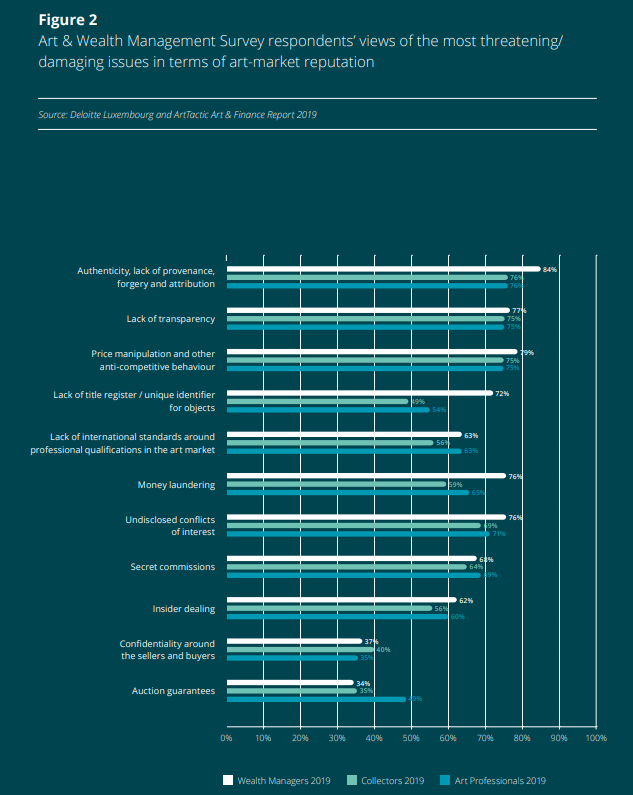

In this year’s survey, 75 percent of collectors said that lack of transparency was one of the biggest threats to the reputation of the market (see Figure 2). This is an increase from 62 percent in the 2017 survey, and marks the strongest consensus on this point since this question was introduced in 2016 with 75 percent of art professionals and 77 percent of wealth managers stating the same.

For 85 percent of the private banks, money laundering is a key threat to the market’s reputation. Governmental regulatory changes may be the antidote to this condition, despite a lack of consensus among market stakeholders about the value of government regulation over self-regulation. The advent of the EU’s 5th Anti-Money Laundering Directive, coming into force in January 2020, may become a catalyst to fight this issue and inspire more regulations to come. The report suggests that collaboration between art and finance stakeholders is essential in order to develop common guidelines and standards to address the deterioration of trust in the art market.

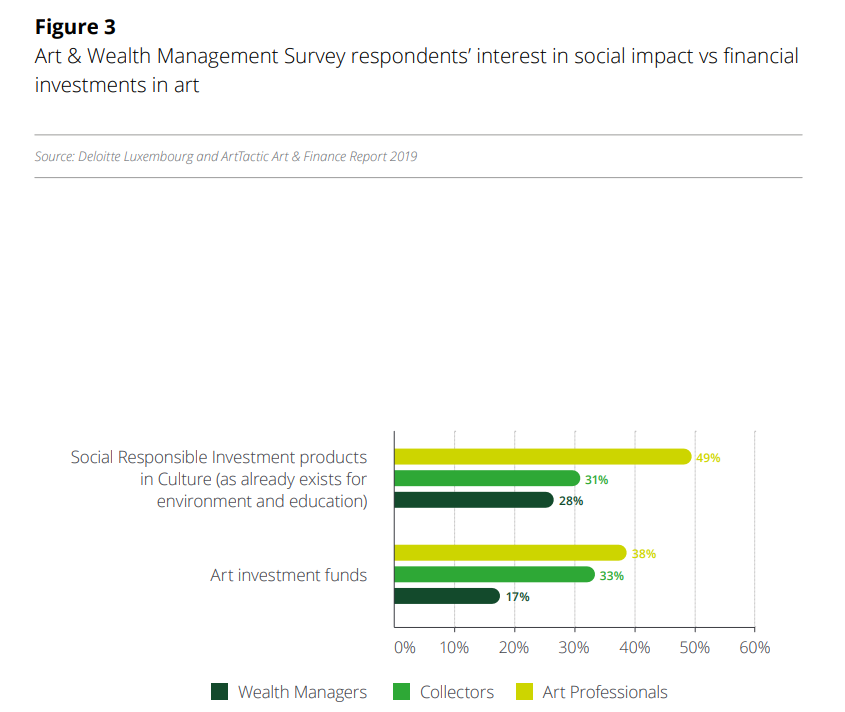

Social impact investment models experience steep rise

For 65 percent of the collectors surveyed, art and philanthropy are among the most relevant services wealth managers can offer. Wealth managers seem to have responded to that trend with more than half stating they will focus on this area in the coming 12 months, up from 40 percent in 2017.

“More and more art investors are keen to support products that have a positive impact on society and the world at large,” states Picinati di Torcello. “New social investment models are required that focus on non-commercial art and cultural projects and institutions. One innovative investment or financing solution could be private-public partnerships. Such partnerships promise to turn public collections into assets with tangible returns so that public institutions have enough funding to fulfil their goals.”

Estate planning rated highly among collectors

Despite a heavily increased focus on social investments and its subsequent growth in the past two years, real estate planning is the most relevant service for 76 percent of collectors (up from 69 percent in 2017). This is closely followed by art valuation services at 73 percent. This indicates that, in line with generational wealth transfer, estate planning and art valuation are two of the collectors’ top priorities. The majority of art professionals acknowledged this demand, with 78 percent and 87 percent of the professionals believing that these two are the most relevant services for their clients.

Split focus on art-secured lending

The market for art-secured lending[1] has grown over the last ten years, with a market size in 2019 estimated to stand at between US$21 billion and US$24 billion in outstanding loans against art. Art-secured lending ranks among the most popular art and wealth management services in 2019: 60 percent of the collectors surveyed reported it would be one of the most relevant art-related services, up from 45 percent in 2017. At the same time, only 16 percent of the European banks surveyed said they will focus on art-secured lending over the next 12 months. This figure stands in stark contrast with the 80 percent of US private banks saying this would be a focal point for them. “One reason for this difference seems to be the lack of a legal framework in Europe. The notion of art as an asset class is less widely understood in Europe than it is in the US. Moreover, there is no uniform system of registration of charges over chattels as in the US with the Uniform Commercial Code (UCC). While each European country has its own system, many of these systems are not suited to the art-secured lending market as it exists in the 21st century,” analyses Picinati di Torcello. According to the Deloitte report, the US therefore dominates the global art-secured lending market with an estimated 90 percent share.

The 2019 Deloitte and ArtTactic Art & Finance report

The renowned Deloitte Art & Finance Report examines the art and finance market through its Wealth Management Survey and via ongoing market research. For the 2019 edition, Deloitte and analysis firm, ArtTactic conducted research between April and June 2019, polling 54 private banks and 25 family offices involved in wealth management, as well as 105 major art collectors and 138 art professionals, including galleries, auction houses, art advisors, art lawyers, art insurers, and art logistics providers.

The sixth edition of the Art & Finance Report was launched today at the annual Deloitte Art & Finance Conference in Monte Carlo, Monaco, under the presence of the Monegasque Minister of Finance and Economy, Jean Castellini, and other renowned speakers of the sector. This year’s 12th Art & Finance Conference focused on new collector trends in art and finance.

The full report can be downloaded from the Deloitte Luxembourg website at: www.deloitte.com/lu/art-finance-report.

2019 Deloitte Art & Finance Conference Sponsors

The 12th Deloitte Art & Finance Conference was organized by Deloitte Luxembourg.

Official conference sponsors: Rosemont International (main sponsor); Artcurial; 4ARTechnologies; Art Analysis & Research; Arteïa; Wildgen Luxembourg Law Firm; VR-All-Art; Bergos Berenberg.

Official media promoters of the conference: The Art Newspaper, MasterArt, artnet, Family Office Magazine & Events, Le Quotidien de l’Art, Excellence Magazine Luxury.

[1] Art-secured lending is the use of art objects for loan collateral. The US art-secured lending market is growing by more than 10% annually.